If you’re a property owner in Harris County, Texas, then you’re probably receiving your tax bill sometime this month or next. How much will you have to pay this year? What factors affect how much you owe? In this blog post, we’ll look at the Harris County property tax rate and what you can do to reduce your taxes. Keep reading for more information!

Many factors affect your property taxes, including exemptions, property descriptions, or protests. The Commissioners Court for the County sets the tax rate, which is currently at $0.377 per $100 valuation. Every year, the Harris County Appraisal District establishes taxable value for property of those living in HCAD. Current property tax bills go out in October/November of each year. Let’s take a closer look at how this all works!

Harris County Property Taxes

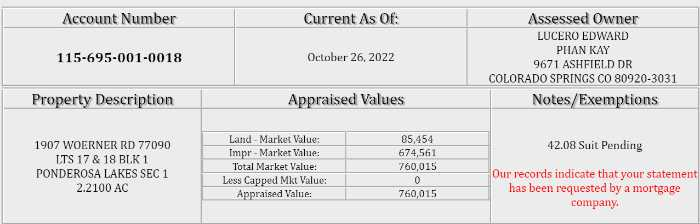

Your tax bill shows the “appraised values” of your property near the top of your bill, along with your owner information, account number, and property description. It also notes any exemptions your account has and any lawsuits the governing body may have against you.

In this property tax bill, you can see that the “owner note” states that there is a lawsuit pending based on Texas Law Code 42.08. FORFEITURE OF REMEDY FOR NONPAYMENT OF TAXES.

The appraised property value for this citizen is a total of $760,015.

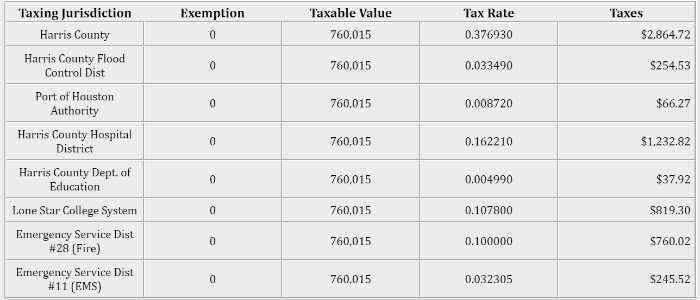

Property tax rates affect your property tax bill each year.

![]()

The Harris County tax office calculates your property tax bill by multiplying the tax rate of each taxing authority with your appraised property value and then moving the decimal to the left twice.

In other words, your tax rate for Harris county is .0037693 multiplied by your property value. If you have an exemption of 40%, then they would take 40% of what you owe off of your bill.

They then add up all of the figures from each tax assessor collector to get your total tax bill.

Overdue Property Taxes

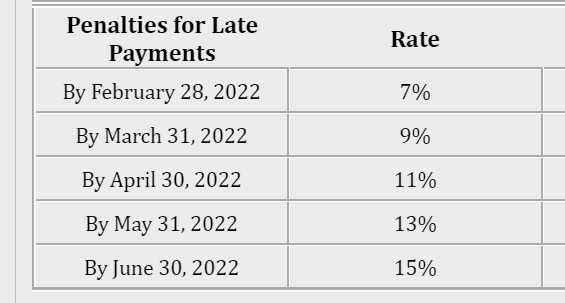

If you haven’t paid your property taxes by February of 2023, the taxing unit will consider you delinquent and begin assessing penalties and interest.

If February comes and your property tax records show you have not paid, the interest will accrue, and you will owe more every month! In addition, you may owe property tax penalties, additional interest, and fees! Now you can see why this taxed citizen has a pending lawsuit!

So let’s look at what you will owe if you don’t pay on time.

- $6,281 if you pay in January of 2023

- $6,721 if you pay in February of 2023

- $6,846 if you pay in March of 2023

- $8,365= $6,971 + $1,394 (20% penalty) = if you pay in April of 2023 (interest plus collection penalty of 15% – 20% of the total unpaid balance is added to the current delinquent account!!!)

The interest rates and penalties only go up from there! By July, you could owe $8,667 or more!

Business personal property taxes that remain delinquent may incur an additional collection fee of 15-20% after April 1st. Real property delinquent taxes incur the additional collection fee of 15-20% on July 1. (1)

Taxing entities use the property tax revenues to pay for governmental agency’s projects and salaries.

Harris County Tax Exemptions

Texas law gives exemptions and deferrals to help reduce the property tax of some property owners. These tax breaks are administered by the Harris County Appraisal District (HCAD).

Pay Quarterly Without Penalties or Interest

If you have an over 65 or disabled exemption or are the surviving spouse of a disabled veteran, you may request to pay your property taxes in 4 equal payments without penalty and interest. (1)

You’ll need to pay 25% of your total property tax and send a written request to pay in installments to Special Tax Services Dept. – P.O. Box 3746 Houston, TX 77253-3746 before January 31st to avoid penalties.

If you send your first payment in Feb, you’ll pay a 6% penalty and 1% interest. Your second quarterly installment is due by March 31st, third by May 31st, fourth by July 31st.

Over 65 Tax Deferral

If you are a homeowner age 65 or over or disabled, you can stop a judgment or tax sale, or defer (postpone) paying delinquent property taxes on your homestead for as long as you own it and live in it.

To postpone your tax payments, file a tax deferral affidavit with your appraisal district. The deferral applies to delinquent property taxes for all of the taxing units that tax your home.

You should be aware that a tax deferral only postpones payments, it does not cancel them. Interest will be added at the rate of at least 5% annually.

Once you no longer own your home or live in it, all the taxes, pre-deferral penalties, and interest, together with the 5% deferral interest, become due after 180 days.

If the taxes remain unpaid, regular penalties and interest accrue, and the taxing units may proceed with a lawsuit to collect delinquent taxes through a tax sale.

Homeowners Facing Tax Foreclosure

If you don’t pay your property taxes by Feb 1 of 2023, your taxing authority places a lien on your property and can start foreclosure proceedings.

State law ensures the taxing authority notifies you in writing, but you don’t have much time to pay your unpaid taxes or defend your homeowner’s status in the courtroom!

Find Legal Help for Tax Foreclosures

If you need help determining a valid defense to halt the foreclosure process on your home, contact us at Jarrett Law Firm. Without a foreclosure defense, Harris country can sell your property in a tax sale to pay your property taxes!

Recent Comments